How to make TDS Deposit

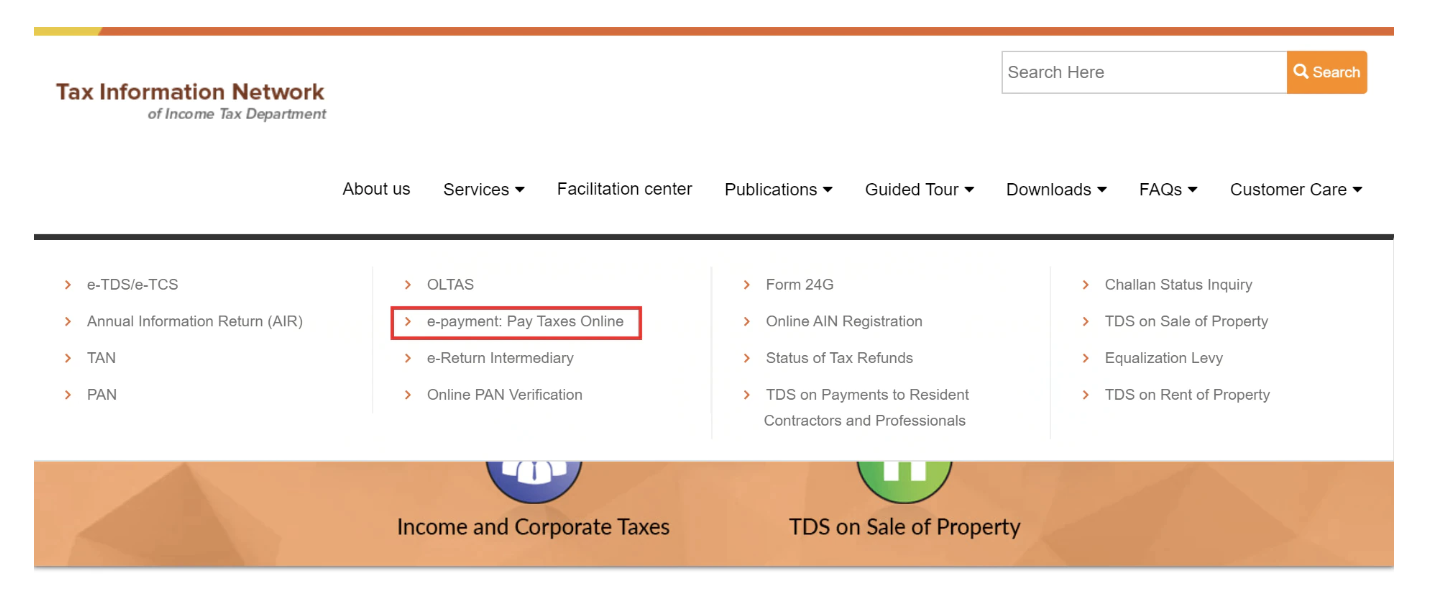

1. Login on TIN NSDL Portal

To pay TDS online visit the website of the income tax department. Following is the link https://www.protean-tinpan.com/

Click on Services and choose ePayment: Pay Taxes Online

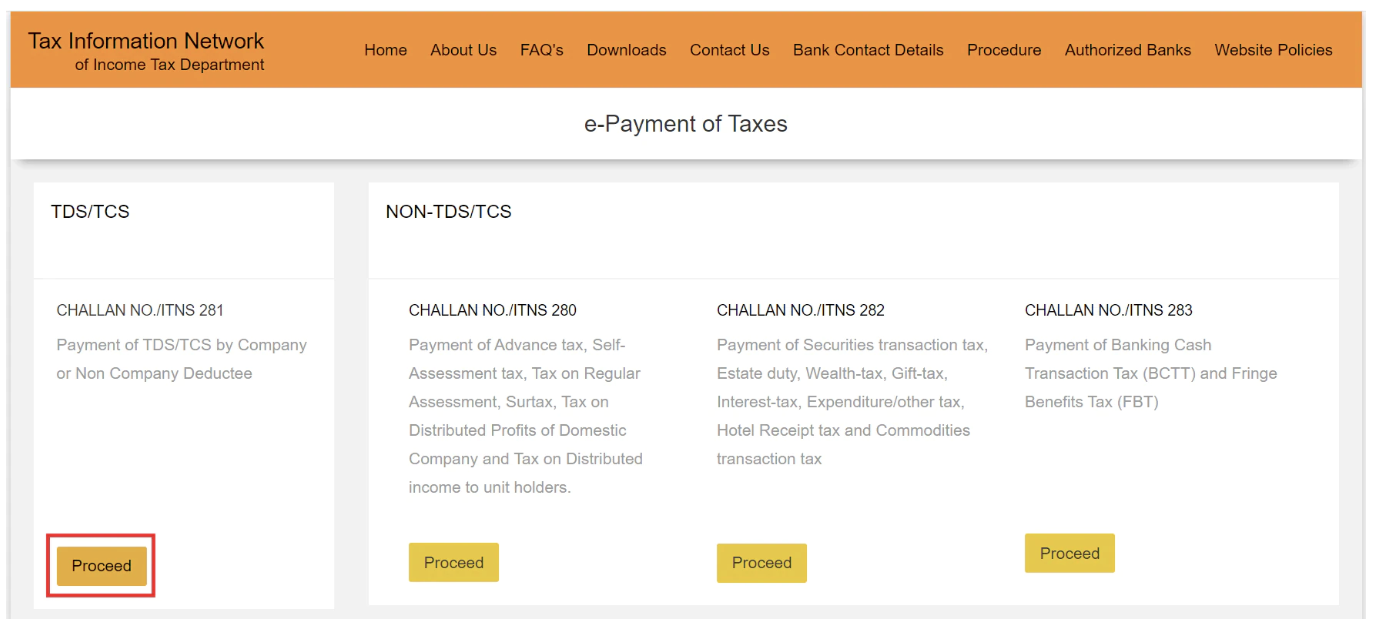

2. Select Challan

Select Challan ITNS 281. This challan is used for depositing TDS/TCS by company or non-company deductees

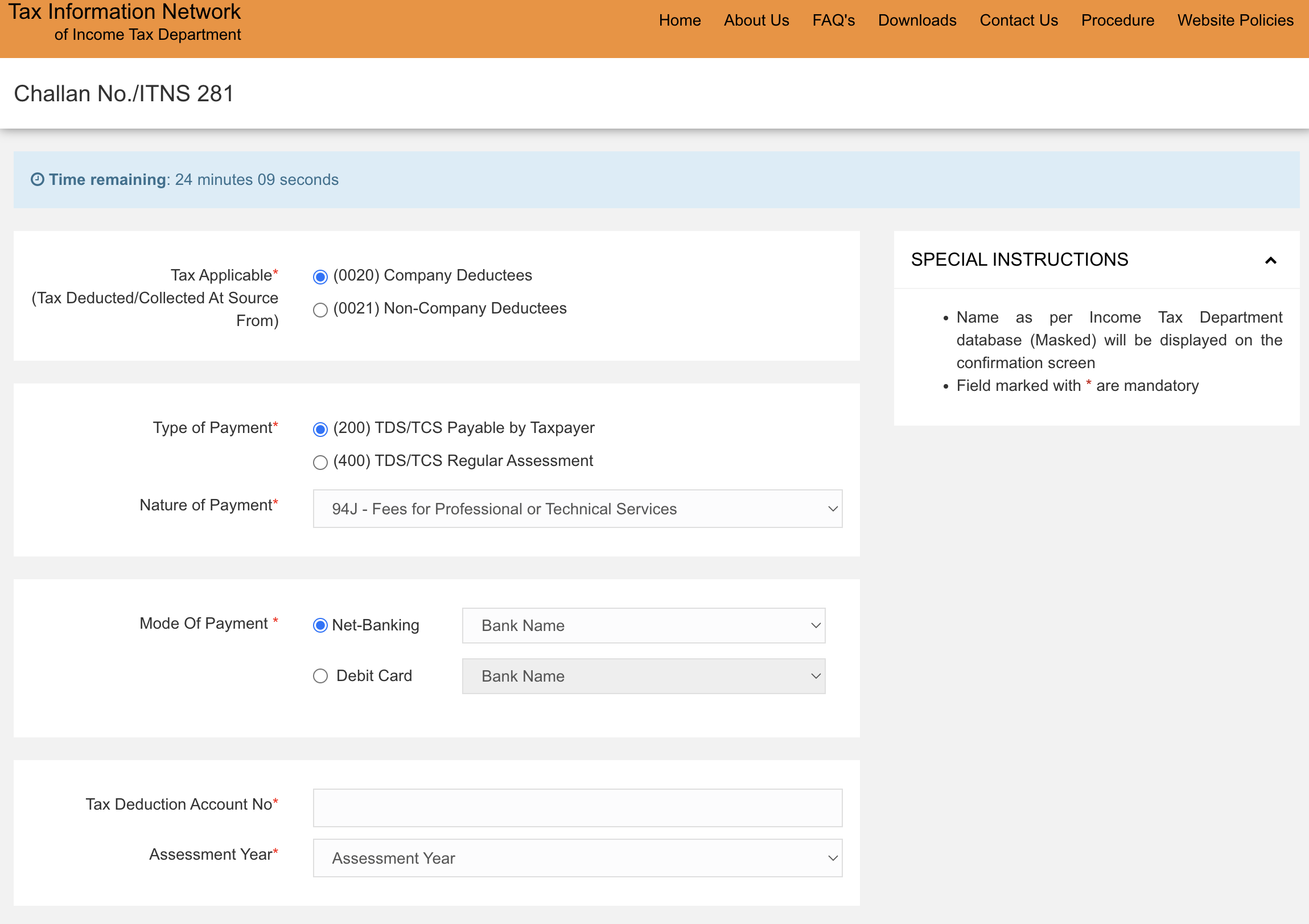

3. Fill in the Challan Details

For Tax Applicable - Select (0020) Company Deductee

Type of Payment - Select (200) TDS/TCS Payable by Taxpayer

Nature of Payment -

Select 94J - Fees for Professional or Technical Services - if you are depositing TDS for Fees paid to Recur

Select 94A - Interest other than Interest on Securities - if you are depositing TDS for Interest paid to Capital Partners

Choose the mode of payment. Payment can be made via Net banking or Debit Card of the taxpayer.

Enter your TAN details. These details are used for online verification to check the validity of TAN. In case the TAN details are not available within the database of the income tax authorities, the taxpayer would not be allowed to proceed further.

Enter the relevant assessment year. The assessment year is the year following the financial year for which income is determined and tax payable thereon. For instance, tax for the income earned during the financial year 2018 – 2019 is payable in the assessment year 2019 – 2020.

Fill in other details like address, email id, mobile number, etc

Enter the captcha code and hit proceed

4. Confirm Challan Details

Once you submit the data by hitting the ‘proceed button’ your dashboard displays the screen that asks you to confirm the challan details previously submitted. Once you go through all the details thoroughly, you need to confirm that the details entered in the challan were correct to the best of your understanding.

5. Make TDS Payment

Once you confirm the challan details, the NSDL portal will redirect you to the net banking page of your bank. Login to your banking page with the help of your user id and password details and make the payment of TDS.

Once the payment is made your dashboard will display a challan counterfoil. This challan counterfoil contains Challan Identification Number (CIN). It also contains payment details, bank names through which e-payment of TDS is made. Bank Branch Code (BSR) and date of tender of challan.

Bank Branch Code is a 7 digit code allotted by RBI to a particular bank branch. The collecting bank branch will transmit the details to the Tax Information Network (TIN) via Online Tax Accounting System (OLTAS). OLTAS is an initiative by the income tax department to receive information and receive records of tax paid through banks. This is done through online upload of challan details.